illinois electric car tax rebate

16 Sep 2021 1258 UTC. The incentive may cover up to 50 of the project cost.

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

6000 per non-networked dual station.

. 15 will expand thousands of dollars in new electric vehicle tax credits to Illinoisans as Gov. JB Pritzker positions Illinois to be a national. Illinois Tax Incentives for Green Drivers.

7500 per networked dual station. Beginning July 1 2022 Illinois will offer a 4000 rebate for a new or used electric vehicle. Federal tax credit for passenger vehicles.

Illinois new climate legislation makes available a 4000 rebate per resident as a way to incentivize them to purchase electric vehicles starting July 1 2022. Theres a lot to unpack in Illinois new 956-page clean energy program including 4000 rebates for electric vehicles subsidies for charging stations and. This is done by offering.

Standard Rebate of 2500 for purchase or lease of a new electric vehicle with a base price under 50000. Among other things this bill includes a 100 tax on electric vehicles. The Naperville EV Chargers program offers a rebate of 700 per charger.

8 a Beginning July 1 2022 and continuing as long as 9 funds are available each person shall be eligible to apply 10 for a rebate in the amounts set forth. CALeVIP Alameda County Incentive Project. The Climate and Equitable Jobs act passed Sept.

In 2021 Governor JB Pritzker and the General Assembly passed the Reimagining Electric Vehicles in Illinois Act REV Illinois Act into law. This groundbreaking program is designed to bolster. Following the release of updated US.

A clean energy bill that just passed in the state of Illinois has set a goal of adding 1 million electric cars to roadways by the end of. Currently there are no state. The rebate program covers Level 2 and.

State has decided to join a parade of. JB Pritzker signed Illinois clean energy law on Wednesday which includes a 4000 rebate for residents to buy an electric vehicle EV. USA December 6 2021.

Illinois vehicle registration fees for electric cars is 251 per registration year. Federal electric vehicle EV tax credits for a few of the countrys largest auto manufacturers one US. Tax credits for heavy duty electric vehicles with 25000 in credit available in 2017 20000 in 2018 18000 in 2019 and 15000 in 2020.

While Illinois doesnt offer rebates as part of its incentive program it does focus on helping to reduce the costs of purchasing and charging an EV or PHEV. Commercial customers who purchase and install EVSE can receive up to 2000 for each charger and up to four rebates per year. Most new EVs are eligible for up to a 7500 federal tax credit.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. Illinois sweeping new clean energy law includes a 4000 rebate on an electric car up to 10 off on your electric bill and up to 9000 back on a solar roof. On Thursday during the fall legislative session for the Illinois General Assembly the Reimagining Electric Vehicles in Illinois tax credit program was approved by a vote of 55-0.

Registration Fees for IL Electric Vehicles. Additionally Illinois offers larger rebates for dual and fast charge stations. Charge Ahead rebate of 5000 for purchase or lease of a new or.

Incentives to drive electric include reducing the cost of your car electric fuel or maintenance. The following are some incentives to convert your fleet to electric. In November 2021 Illinois Governor JB Pritzker signed the Reimagining Electric Vehicles Act the REV Act which together with the recently enacted.

Coleman received a 7500 federal tax credit on his 40000 Chevy Bolt last year. At least 50 of the qualified vehicles. President Bidens EV tax credit builds on top of the.

The Illinois Environmental Protection Agency IEPA will provide transportation electrification grants of 70000000 for but not limited to electric vehicle charging infrastructure. The bill also doubles the state gas tax from 19 to 38 cents to help pay for these improvements. Most new passenger automobiles are eligible for a federal tax credit of up.

Reimagining Electric Vehicles Rev Illinois Program Rev

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

/cloudfront-us-east-1.images.arcpublishing.com/gray/BMPNTS44YJHYDADVOL35VE5HZI.png)

Looking For Extra Cash Illinois Will Give You 4 000 For Buying An Electric Car

Latest On Tesla Ev Tax Credit March 2022

Illinois Enacts Tax Incentives To Attract Electric Vehicle Manufacturing Mayer Brown Tax Equity Times Jdsupra

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Rebates And Tax Credits For Electric Vehicle Charging Stations

Electric Car Tax Credits What S Available Energysage

Illinois 4 000 Ev Tax Credit Ask The Hackrs Forum Leasehackr

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Illinois Will Pay Residents 4k To Buy An Electric Car Autoevolution

Ford Electric Vehicles Ford Hybrids Near Plainfield Il

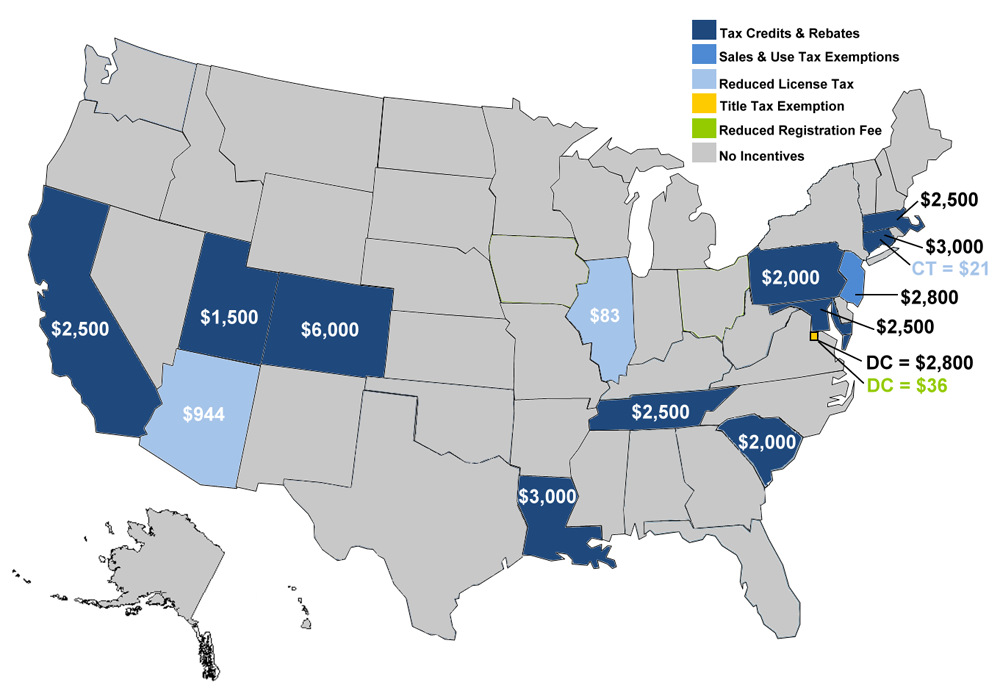

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Fact 891 September 21 2015 Comparison Of State Incentives For Plug In Electric Vehicle Purchases Department Of Energy

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

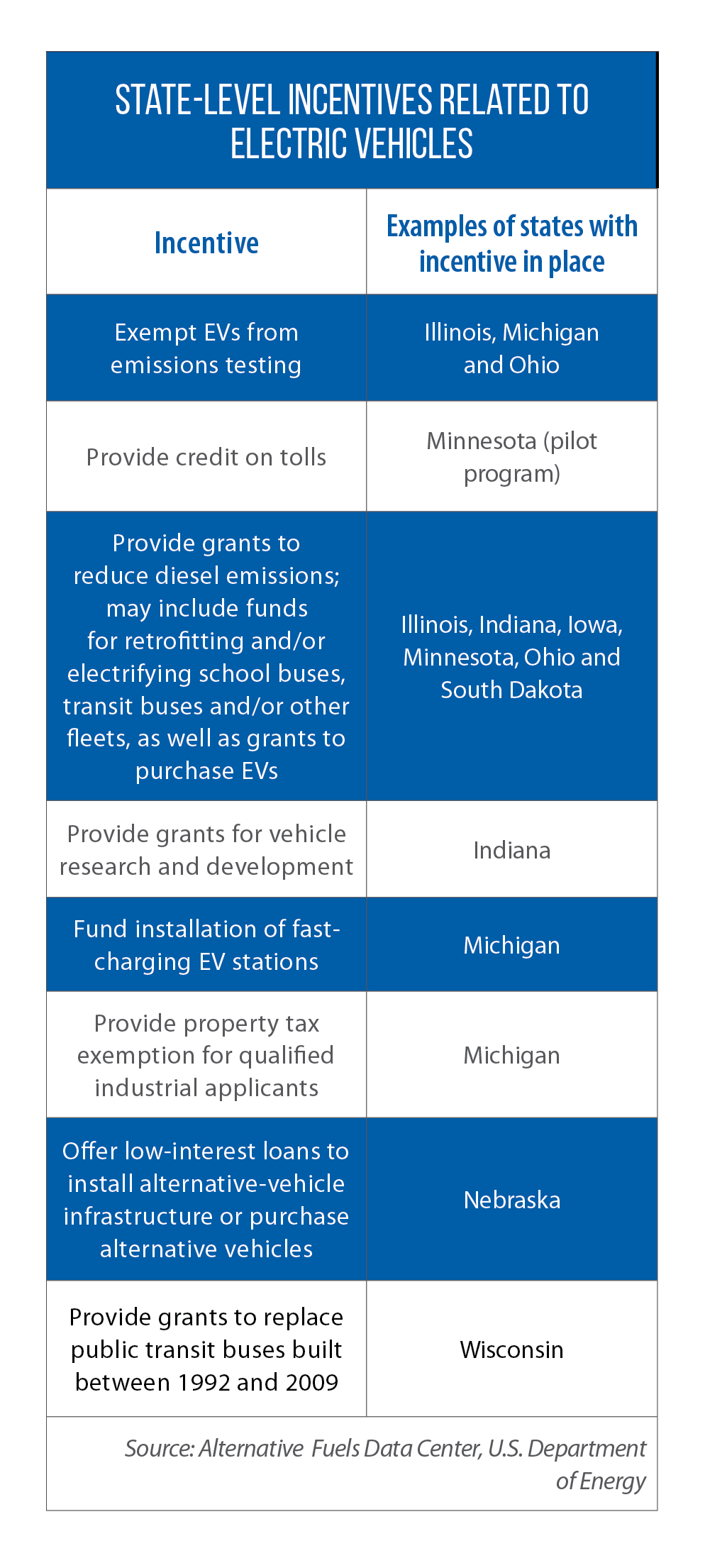

Power Up How The Midwest Is Planning And Preparing For Rise Of Electric Vehicles Csg Midwest